It’s important to understand that your Form W-2 displays your taxable wages after pre-tax deductions have been taken out. These deductions can include things like employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. This is why your W-2 may not match up with your last pay stub. It’s essential to keep this in mind when filing your taxes to ensure accuracy.

Why is my W-2 not matching my salary?

It’s common to feel confused when your W2 doesn’t match your salary. However, it’s important to understand that your salary is the total amount you earned before taxes and deductions, while your W2 shows your taxable income after pre-tax deductions. This means that your W2 will always be lower than your salary. It’s essential to keep track of your pre-tax deductions, such as health insurance and retirement contributions, to ensure that your W2 accurately reflects your taxable income.

By understanding the difference between your salary and W2, you can avoid any surprises when tax season rolls around.

What is the difference between W-2 and final pay stub?

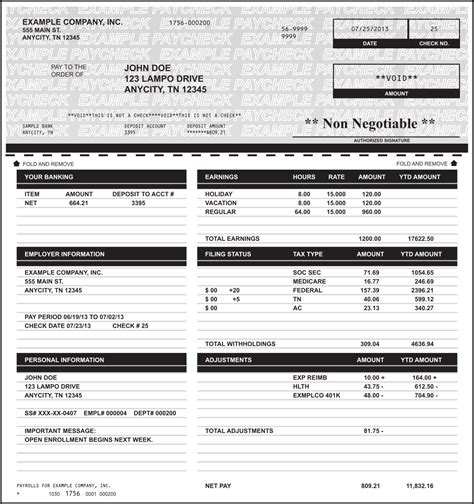

“`When it comes to understanding your earnings for the year, it’s important to differentiate between your year-end pay stub and your Form W-2. Your pay stub will show your total or gross earnings received throughout the year, while your Form W-2 will show your yearly taxable earnings. It’s common for there to be a discrepancy between the two, and there are several reasons why this may occur.“`

How do I convert my last pay stub to W-2?

If you’re missing a W-2 form or your employer hasn’t provided one, don’t worry! You can still file your taxes by downloading Form 4852 from the IRS website. To complete the form, you’ll need a copy of your last paystub, which should include important details such as your wages, tips, and other compensation, as well as your social security wages. With this information, you can accurately fill out Form 4852 and submit it along with your tax return. Don’t let a missing W-2 form stress you out – use Form 4852 to ensure you meet the tax deadline and avoid any penalties.

Why are my wages different on W-2?

Many people wonder why their W-2 wages don’t match their final pay stub for the year, or why the Federal and State wages listed on their W-2 don’t match the Social Security and Medicare wages. The reason for these discrepancies is that each wage amount is taxable in a different way. In other words, certain wages may be subject to different taxes or deductions, which can affect the final amount listed on your W-2. While this can be confusing, it’s important to understand how your wages are being taxed so that you can accurately report your income and avoid any potential issues with the IRS.

Can an employer make a mistake on W-2?

The main takeaway is that receiving an incorrect W-2 form can happen due to human or computer error. However, it’s important to address the issue promptly by both the employee and employer to correct the mistake and ensure the correct taxpayer information is submitted to the IRS. By doing so, there’s no need to worry about facing any penalties.

Is it possible for a W-2 to be wrong?

In case your W-2 Form is incorrect, it’s important to request a corrected one. If you’ve been unsuccessful in obtaining the corrected form by the end of February, you can ask an IRS representative to file a Form W-2 complaint with your employer on your behalf. This will ensure that you receive the correct information needed for tax purposes.

What to do if your employer refuses to correct your W-2?

If you’ve received an incorrect Form W-2 from your employer, don’t panic. You can contact the IRS by calling their toll-free number at 800-829-1040 or by scheduling an appointment to visit an IRS Taxpayer Assistance Center (TAC). Once you’ve notified the IRS, they will send a letter to your employer requesting that they provide you with a corrected Form W-2 within ten days. It’s important to take action as soon as possible to avoid any potential penalties or delays in filing your taxes.

How do I know my W-2 is correct?

To ensure that your W-2 form is correct, you should review it carefully and compare it to your own records. Check that your name, Social Security number, and address are accurate. Verify that your total wages, federal and state taxes withheld, and any other deductions or income are correct. If you notice any errors, contact your employer immediately to request a corrected form.

Keep in mind that mistakes can happen, so it’s important to double-check your W-2 to avoid any potential issues with the IRS. Additionally, if you have any questions or concerns about your taxes, consider consulting a tax professional for guidance.

What happens if your employer messes up your taxes?

If you find yourself in a situation where your employer or payroll department has messed up your taxes and you now owe money to the IRS, it’s natural to wonder if you’re responsible for the mistake. Unfortunately, the answer is usually yes. Even if your employer made the error by not withholding enough taxes during the year, you’re still responsible for paying the taxes owed to the IRS. However, there are some situations where you may be able to get relief from the IRS, such as if you can prove that the mistake was not your fault or if you can negotiate a payment plan.

It’s important to consult with a tax professional to understand your options and avoid any further penalties or fees.

What to do if your employer messes up your paycheck?

As an employee, it’s important to keep an eye on your paycheck and report any errors to your employer promptly. Be sure to clearly communicate the issue and provide a copy of your pay stub as evidence. This will allow management or HR to address the problem quickly and ensure that you receive the correct amount of pay. Don’t hesitate to speak up if you notice any discrepancies, as it’s your right to receive accurate compensation for your work.

Will the IRS catch a missing W-2?

Are you worried about not receiving your W2 on time? It’s understandable to feel anxious about this, but rest assured that the IRS will catch any missing W2s. Employers are required by law to send W2s to their employees, including caregivers, by January 31st of each year. So, if you haven’t received your W2 by then, be sure to follow up with your employer to avoid any potential issues with the IRS.

How do I correct a payroll underpayment?

To correct a payroll underpayment, you should first determine the cause of the error. Check for any mistakes in the employee’s hours worked, rate of pay, or deductions. Once you have identified the issue, calculate the amount owed to the employee and make the necessary adjustments in your payroll system. It’s important to communicate with the employee about the error and the steps being taken to correct it.

You may also need to file amended tax forms with the IRS and state tax agencies. To avoid future underpayments, review your payroll processes and consider implementing automated systems or seeking professional assistance.

Whose responsibility is it to correct errors on your pay stub?

According to the California Labor Code, it is the employer who is accountable for ensuring that wage statements are precise and complete. This responsibility cannot be transferred to a payroll company. Therefore, it is crucial for employers to take this responsibility seriously and ensure that they are providing accurate wage statements to their employees. Failing to do so can result in legal consequences and negatively impact the employer’s reputation.

How do I know if I’m being underpaid?

If you find yourself in a situation where you are earning less than a colleague who has the same job, industry, and location as you, and you have more experience, then it’s highly likely that you are being underpaid. After conducting thorough research and speaking with others in your industry, it’s time to approach your manager and discuss the possibility of a raise. It’s important to advocate for yourself and your worth in the workplace.

What happens if your employers accidentally overpay you on a paycheck?

“`If you have overpaid an employee, you can reclaim the excess amount by deducting it from their future wages. This is allowed under federal law, and you don’t need the employee’s permission or advance notice to do so. Even if the deduction causes the employee’s wages to fall below the minimum wage, it is still permissible.“`

What is your actual wage on W-2?

If you’re wondering what Box 1 on your earnings statement means, it’s referring to your wages, tips, and other compensation. This box will typically show your year-to-date gross earnings, which is the total amount you’ve earned before any pre-tax deductions are taken out. These deductions could include things like health, dental, or vision insurance, flexible spending accounts, and retirement or tax-deferred savings plans. So, if you’re trying to calculate your taxable income for the year, Box 1 is a good place to start.

Why do I get taxed differently each paycheck?

When it comes to determining your federal income tax withholding from your paycheck, there are a few key factors to consider. First and foremost is your filing status, which should be indicated on your W-4 form. Additionally, the number of dependents or allowances you specify can also impact your withholding. Finally, any other income or adjustments you’ve reported on your W-4 can also play a role in determining your withholding amount.

It’s important to keep these factors in mind when filling out your W-4 to ensure that you’re withholding the appropriate amount of taxes from your paycheck.

How could you check your W-2 form to be sure it is correct?

To check the accuracy of your W-2 form, start by comparing the information on the form to your own records, such as pay stubs and tax documents. Check that your name, Social Security number, and address are correct. Verify that your wages, tips, and other compensation are accurately reported, as well as any taxes withheld. If you find any errors, contact your employer to request a corrected form.

Additionally, you can use the IRS’s online tool, “Get Transcript,” to view your wage and income information reported to the IRS. It’s important to ensure the accuracy of your W-2 form to avoid any potential issues with your tax return.

Why are my local wages lower than federal?

When it comes to taxes, the distinction between federal and state wages often lies in what income is considered taxable. Some states may not deduct certain items from state salaries that are excluded from federal wages, such as contributions to specific retirement accounts. This can result in differences in the amount of taxable income and ultimately affect the amount of taxes owed.

Related Article

- Why Does My Vuse Pod Taste Burnt When It’S Full?

- Why Does My Tv Keep Going Back To Home Screen?

- Why Does My Truck Say Service Def System See Dealer?

- Why Does My Traeger Take So Long To Heat Up?

- Why Does My Thread Keep Coming Out Of The Needle?

- Why Does My Skin Itch After Using A Massage Gun?

- Why Does My Skin Feel Tight After Washing My Face?

- Why Does My Roku Keep Going Back To Home Screen?

- Why Does My Rabbit Scratch The Bottom Of Her Cage?

- Why Does My Puff Bar Taste Burnt After One Day?