Insurance quotes can change daily due to various factors such as changes in the market, new regulations, and individual risk factors. Insurance companies use complex algorithms to calculate premiums based on a variety of factors including age, location, driving record, and credit score. These factors can change over time, causing fluctuations in insurance quotes. Additionally, insurance companies may adjust their rates based on market trends and competition.

It’s important to regularly review insurance quotes and shop around to ensure you are getting the best coverage at the most affordable price.

Why does my insurance quote keep changing?

It’s no secret that getting into an auto accident or receiving a traffic violation can cause your car insurance rates to increase. However, there are other factors that can also contribute to a rise in premiums. For instance, simply changing your address or purchasing a new vehicle can result in higher insurance costs. Additionally, if there have been a high number of claims filed in your zip code, this can also impact your rates.

It’s important to be aware of these potential factors so that you can make informed decisions about your car insurance coverage.

What time of day is car insurance cheapest?

Did you know that the time of day you purchase car insurance can affect the price you pay? Confused.com conducted research that found the most affordable time to buy car insurance is between 6 am and 9 am. This data suggests that taking a few minutes in the morning to shop around for car insurance could save you money in the long run.

How accurate are insurance quotes?

Getting an online car insurance quote is a convenient and reliable way to estimate your insurance costs. However, it’s crucial to remember that the accuracy of your quote depends on the information you provide. If you fail to provide accurate information, your quote may be higher or lower than expected. This is why insurance companies ask so many questions.

They need to gather as much information as possible to provide you with an accurate quote. So, it’s essential to be honest and provide all the necessary details to get the most accurate quote possible.

Can my insurance quote change?

It may appear random, but there are legitimate explanations for why your car insurance rates fluctuate. Several factors can influence the cost of your coverage, such as filing claims, your driving record, adding new drivers to your policy, and even your credit score. These variables can all play a role in determining your car insurance rates.

What is quote manipulation in insurance?

Quote manipulation refers to the act of intentionally altering information on an insurance application to lower the premium. This is typically done by the proposer during the quote process. It is important to note that quote manipulation is considered fraud and can result in serious consequences. It is crucial to provide accurate and truthful information when applying for insurance to ensure that you are properly covered and avoid any legal issues.

How often should you shop around for insurance quotes?

As an AI language model, I do not have personal opinions or experiences. However, it is generally recommended to shop around for insurance quotes at least once a year or whenever there is a significant change in your life circumstances, such as getting married, having a child, or buying a new car. This is because insurance rates can vary widely between providers and may change over time. By comparing quotes from multiple insurers, you can ensure that you are getting the best coverage at the most affordable price.

Additionally, shopping around can help you identify any gaps in your coverage or opportunities to save money by bundling policies or taking advantage of discounts.

What is the best time to buy car insurance?

It’s no secret that car insurance can be a significant expense for many people. However, did you know that the timing of your renewal can impact how much you pay? Typically, the closer you get to your renewal date, the higher your premiums will be. To save money, it’s best to renew your policy about two to four weeks before the expiration date. This way, you can take advantage of lower rates and avoid any last-minute price hikes.

What are 4 things that insurance companies evaluate before giving you a price quote?

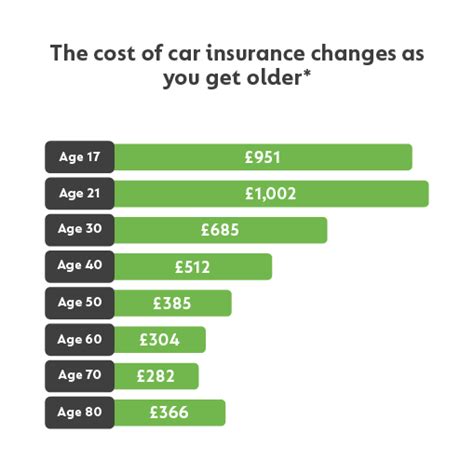

Insurance companies evaluate several factors before giving you a price quote. Firstly, they consider your age, as younger drivers are considered riskier and may have to pay higher premiums. Secondly, they evaluate your driving record, including any accidents or traffic violations. Thirdly, they assess the type of vehicle you drive, as more expensive or high-performance cars may require higher premiums.

Finally, they consider your location, as areas with higher crime rates or more traffic congestion may result in higher premiums. These factors help insurance companies determine the level of risk associated with insuring you and ultimately determine the price quote you receive.

How many quotes should you get for insurance?

“`It’s important to do your due diligence and compare at least five insurance quotes before making a decision. While a low premium rate may seem attractive, it’s crucial to consider other factors that can impact your protection in the long-run. Here are some tips to help you make an informed decision and ensure that your insurance policy provides the coverage you need.“`

What is the 80% rule in insurance?

The 80% rule is a policy implemented by insurance companies that only covers the expenses of damage to your property or house if you have purchased coverage that is equal to or greater than 80% of the total replacement value of the property. This means that if you have not purchased enough coverage, you may be responsible for paying a significant portion of the repair costs out of pocket. It is important to ensure that you have adequate coverage to protect your property and finances in the event of unexpected damage or loss.

Do insurance quotes hurt credit?

When you’re applying for insurance, it’s common for companies to check your credit score. But don’t worry, this is just a ‘soft pull’ inquiry, which won’t have any impact on your credit score. You may notice these inquiries on your credit report, but they won’t be visible to anyone else. So, rest assured that checking your credit score for insurance purposes won’t harm your credit in any way.

Why is my insurance higher than the quote?

It’s not uncommon for your insurance premium to end up costing more than your initial quote. This is because insurance quotes are typically based on estimated information, and there may be discrepancies that arise during the underwriting process. Factors such as your driving record, credit score, and claims history can all impact your final premium. It’s important to review your policy details carefully and ask your insurance provider about any potential rate increases to ensure you’re getting the coverage you need at a price you can afford.

How can I avoid paying high insurance?

There are several ways to avoid paying high insurance premiums. First, shop around and compare rates from different insurance providers. You may be able to find a better deal by switching to a different company. Second, consider increasing your deductible.

A higher deductible means you’ll pay more out of pocket if you have a claim, but it can also lower your monthly premium. Third, maintain a good credit score. Insurance companies often use credit scores to determine rates, so a higher score can lead to lower premiums. Finally, take advantage of any discounts you may be eligible for, such as safe driver discounts or bundling multiple policies with the same provider.

Do insurance companies have to honor quotes?

When it comes to insurance quotes, it’s important to keep in mind that they are simply estimates. There are many factors that can affect the final cost, so the quote is not a binding agreement. This means that the insurance company is not obligated to honor the quote. While it can be frustrating to receive a higher bill than expected, it’s important to understand that the quote is not a guarantee.

It’s always a good idea to review your policy carefully and ask any questions you may have before signing up for insurance.

Why is my Geico quote so high?

If you’re a Geico customer, you may have noticed that your rates can increase for a variety of reasons. Adding more coverage, getting into an accident, receiving a speeding ticket, or filing a claim are all factors that can cause your rates to go up. Additionally, certain life events, such as adding a teenage driver to your policy, can also result in higher premiums. It’s important to note that you may also lose discounts, which can further increase your rates.

Can insurance go up after quote?

When obtaining a car insurance quote, it’s important to provide accurate information to ensure that the rate you receive is as close to the final rate as possible. If you only provide the make and model of your vehicle without the VIN, your rate may change once you enter the full VIN. Additionally, leaving out any information about past accidents, no matter how minor, can result in a higher policy rate. It’s best to be upfront and honest about all relevant details to avoid any surprises later on.

Why is my insurance higher than the quote?

It’s not uncommon for your insurance premium to end up costing more than your initial quote. This is because insurance quotes are typically based on estimated information, and there may be discrepancies that arise during the underwriting process. Factors such as your driving record, credit score, and claims history can all impact your final premium. It’s important to review your policy details carefully and ask your insurance provider about any potential rate increases to ensure you’re getting the coverage you need at a price you can afford.

Can insurance companies match quotes?

If you’ve found a lower rate with a competitor, it’s unlikely that your company will be able to directly match it. However, it’s still worth reaching out to them for an updated quote. Even if the difference isn’t significant, they may be able to make some adjustments to make your rate more competitive. Don’t hesitate to explore your options and see if you can get a better deal.

Does quoting insurance affect credit?

When you’re applying for insurance, it’s common for companies to check your credit score. But don’t worry, this is just a ‘soft pull’ inquiry, which won’t have any negative impact on your credit score. These inquiries will only be visible on your personal credit reports and won’t affect your overall credit rating. So, you can rest assured that your credit score won’t be affected when you’re shopping around for insurance quotes.