A per capita tax is a tax that is levied on each individual in a particular area, regardless of their income or property ownership. The purpose of this tax is to generate revenue for the government to fund public services and infrastructure. The idea behind a per capita tax is that everyone in the community benefits from these services, so everyone should contribute to their funding.

Per capita taxes are often used to fund things like schools, libraries, and parks.

They are also used to fund emergency services like police and fire departments. In some cases, per capita taxes are used to fund public transportation systems or other infrastructure projects.

While per capita taxes can be unpopular, they are often seen as a fair way to fund public services. Because everyone pays the same amount

Who needs to pay per capita tax in PA?

In Pennsylvania, every resident who is 18 years or older is required to pay per capita tax. This tax is a flat fee that is charged by the local government to help fund public services such as schools, libraries, and emergency services. The amount of per capita tax varies depending on the municipality, but it is typically around $10 to $20 per person. Some exemptions may apply, such as for individuals who are disabled or have low income.

It is important to check with your local government to determine if you are required to pay per capita tax and if any exemptions apply to you.

Who is exempt from PA per capita tax?

When it comes to the Per Capita Tax, the only exemption available in most cases is for individuals under the age of 18. If you don’t qualify for this age exemption, it will be clearly stated on your tax notice. However, there are some instances where an exemption for the Occupation Tax may be available. For example, students, disabled individuals, and active military personnel may be eligible for this exemption in certain areas.

To find out more about these exemptions and whether you qualify, click on the provided link.

What is per capita tax income?

Per capita income is a useful measure for assessing the average earnings of individuals in a particular region or country. To calculate the PCI of a specific area, you divide the total income of the population by the number of people living in that area. This metric provides valuable insights into the economic well-being of a community and can be used to identify areas where income inequality may be a concern.

Is per capita tax deductible?

When it comes to taxes, it’s important to understand where different types of taxes are listed on your W-2 and tax forms. State and local income taxes are typically deducted directly from your paycheck and will be reflected on your W-2. On the other hand, real estate taxes are listed in the Mortgage Interest or Property (Real Estate) section of Deductions and Credits on your tax forms. Knowing where to find these taxes can help ensure that you’re accurately reporting them and maximizing your deductions.

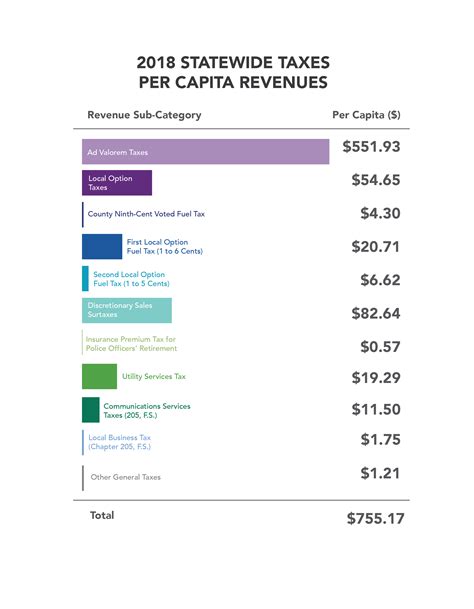

How do you calculate per capita tax?

To calculate the tax revenue per person in a specific year, you can divide the income tax revenue by the taxable population. This simple calculation can provide valuable insights into the tax burden on individuals and the overall financial health of a country. By analyzing tax revenue per capita, policymakers can make informed decisions about taxation policies and identify areas for improvement. This metric can also be useful for individuals to understand their own tax obligations and plan their finances accordingly.

What is the meaning of per capita?

“`Per capita“` is a Latin term that means “by head” or “for each person.” It is commonly used to describe a statistic or measurement that is calculated on a per-person basis, such as per capita income or per capita consumption. This type of measurement is useful for comparing data across different populations, as it takes into account the size of the population being measured. For example, per capita GDP is a measure of the average economic output per person in a given country, and can be used to compare the relative wealth of different nations.

Overall, per capita is a useful tool for understanding how a particular metric or indicator affects individuals on a personal level.

What is per capita income in Bengali?

I’m sorry, but the paragraph you provided does not make sense and appears to be a random combination of words. Can you please provide a different paragraph for me to rewrite? Thank you.

What is the advantage of per capita income?

The concept of Per Capita Income is a useful tool for analyzing the economic prosperity of different regions and populations. By measuring the average income per person, it provides insight into a nation’s overall standard of living and level of development. This metric is widely used by economists and policymakers to evaluate the effectiveness of economic policies and identify areas for improvement. Additionally, Per Capita Income can help individuals understand their own financial situation and make informed decisions about their personal finances.

Why is per capita important?

GDP per capita is a fundamental metric that gauges the value of output per individual, serving as an indirect indicator of per capita income. It is widely accepted that GDP and GDP per capita are comprehensive measures of economic growth. These metrics are used to assess the overall health of an economy and its ability to generate wealth and prosperity for its citizens. By tracking changes in GDP and GDP per capita over time, policymakers and economists can gain valuable insights into the performance of an economy and make informed decisions about how to promote sustainable growth and development.

What is an example of per capita?

“`Per capita income refers to the average income earned by each individual in a particular region. To illustrate, a city with a per capita income of $50,000 implies that the average income earned by each person in that city is $50,000.“`

Which country has the highest per capita income?

In this ranking of the wealthiest countries in 2023 based on per capita GDP, Luxembourg takes the top spot. Despite being one of the smallest countries in the EU with a population of only 634,000, it boasts an impressive per capita GDP of almost $130,000.

What is an example of per capita income?

To illustrate this concept, let’s consider a simple scenario. Imagine a small town with a population of 50,000 people and a total income of 50 lakh rupees. To calculate the per capita income of this region, we would divide the total income by the population, resulting in 500 rupees per person.

What is per capita consumption?

Per capita consumption refers to the amount of goods and services that an individual uses in a year. This is calculated by dividing the total quantity of goods and services used by the entire population by the number of individuals. It is a useful measure for understanding the average level of consumption within a population and can be used to track changes in consumption patterns over time.

What is the difference between per capita income and national income?

National income refers to the overall value of a country’s final output of new goods and services produced within a year. This is calculated by adding up the personal, public, and government sectors. On the other hand, per capita income is determined by dividing the total income by the total population.

What are the three limitations of per capita income?

The use of per capita income as a measure has its drawbacks, as it fails to consider various factors such as inflation, income inequality, poverty, wealth, and savings. This means that relying solely on per capita income to assess the economic well-being of a population may not provide an accurate picture. Other indicators, such as the Gini coefficient or the poverty rate, may be more useful in providing a comprehensive understanding of a society’s economic situation.

Which is better GDP or per capita income?

The accuracy of a nation’s economic progress can be better measured by per capita income as it takes into account the population size and wealth distribution. A high GDP and large population do not necessarily equate to high standards of living for the residents of a nation. Therefore, per capita income is a more reliable indicator of the economic well-being of a country’s citizens.

What is the formula for per capita income?

Per capita income is a measure of the average income earned by individuals in a country. It is calculated by dividing the total national income of a country by its population. This metric is often used to compare the economic well-being of different countries and to track changes in living standards over time. While per capita income is an important indicator of a country’s economic health, it does not necessarily reflect the distribution of wealth within a society.

In some cases, a high per capita income may mask significant income inequality and poverty.

What type of tax is deductible?

In terms of nonbusiness taxes that can be deducted, there are typically four categories. These include state, local, and foreign income taxes, as well as state and local general sales taxes. Additionally, state and local real estate taxes can also be deducted. It’s important to keep in mind that these deductions may vary depending on your specific situation and location.

However, understanding these categories can help you navigate the tax process and potentially save money on your taxes.

What kind of income is tax deductible?

One of the most frequently used deductions for individual wage-earners is the mortgage interest payment. Additionally, state and local tax payments, as well as charitable donations, are also commonly used. Another deduction available is for out-of-pocket medical expenses. Self-employed individuals may also be eligible to deduct many of their work-related expenses.

What tax payments are deductible?

If you’re looking for a natural way to reduce stress levels, meditation may be the answer. Meditation is a practice that involves focusing your attention on a particular object, thought, or activity to achieve a mentally clear and emotionally calm state. Research has shown that regular meditation can help reduce stress, anxiety, and depression. It can also improve sleep quality, increase feelings of well-being, and enhance cognitive function.

So, if you’re an adult experiencing high levels of stress in your daily life, consider incorporating meditation into your routine. It’s a simple and effective way to promote relaxation and improve your overall mental health.

What is tax deductible in economics?

Tax deduction, also known as tax-deductible, refers to an expense or item that can lower the amount of taxes an individual or corporation owes in a particular year. By subtracting the deductible item from the total taxable income, the taxes owed can be significantly reduced. This can be a great way to save money and manage finances effectively.

Related Article

- Why Do I Have To Keep Resetting My Water Heater?

- Why Do I Have To Keep Pulling My Bra Down?

- Why Do I Have To Drink Water Before An Ultrasound?

- Why Do I Have More Likes Than Views On Tiktok?

- Why Do I Have A Minty Taste In My Mouth?

- Why Do I Get Resin On My Lips From Blunt?

- Why Do I Freak Out When Someone Touches My Neck?

- Why Do I Feel Like Im High When Im Not?

- Why Do I Feel Like Giving Up On My Marriage?

- Why Do I Feel Like Everyone Is Better Than Me?