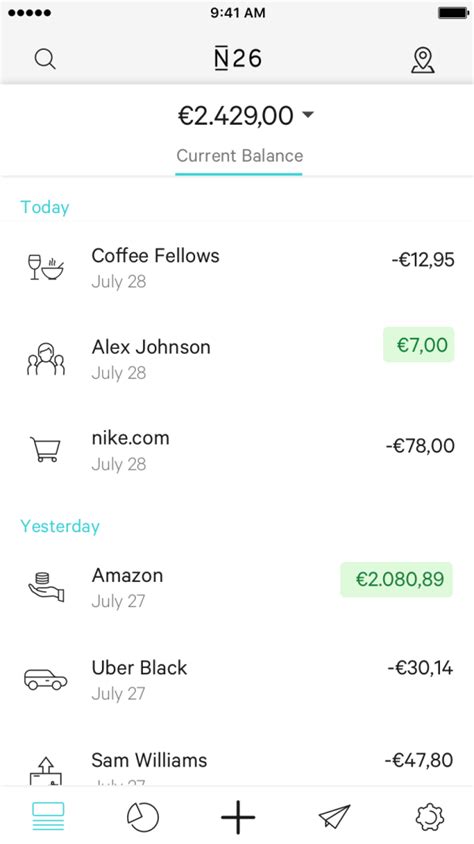

When you see a pending deposit in your bank account, it means that the funds have not yet been cleared and are being held by the bank. This deposit does not immediately increase your account balance. However, if all goes smoothly, the pending deposit will disappear after a few days, and a regular deposit will appear in a separate section of your statement. This regular deposit will then be added to your account balance.

Why would a pending payment disappear?

If you notice that a pending transaction has disappeared from your transaction history and the amount has been returned to your available balance, don’t worry. This simply means that the transaction has expired and has not been processed by the merchant yet. It’s important to note that if this happens, any dispute you may have had regarding the transaction will be closed.

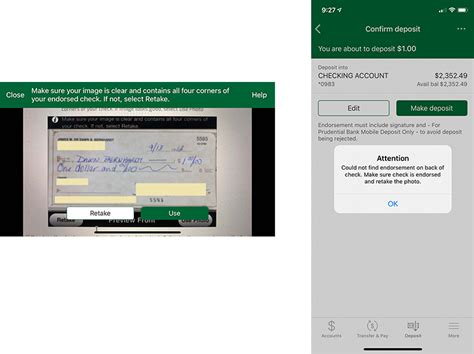

Why is my deposited check not showing up in my account?

It’s not a straightforward answer. If you’re unsure about a deposit, it’s best to reach out to your bank and provide them with all the necessary details, such as a copy of the deposit receipt. Keep in mind that the bank may not consider the receipt as definitive proof that you deposited the exact amount stated on it. It’s always better to be safe than sorry, so don’t hesitate to contact your bank for clarification.

Can a pending bank deposit be Cancelled?

“`It is possible to delete or reverse payments. However, to ensure that an on-line check can be processed before the original check date, the delete action must be requested at least two full business days in advance.“`

Why is my refund pending then disappeared?

If you’ve ever noticed a pending refund disappear from your transaction history, don’t worry – it’s not necessarily a bad thing. In fact, it could mean that the transaction has expired or been cancelled, and the funds have been returned to your available balance. This typically happens when the merchant doesn’t process the refund in a timely manner. While it can be frustrating to see a pending refund disappear, it’s important to remember that the funds should still be available to you.

If you’re unsure about the status of a refund, it’s always a good idea to reach out to the merchant or your bank for clarification.

How long does it take for a pending refund to hit your account?

“`The processing time of banks can vary, and it may take between 5 to 10 business days for the refund to reflect in your customer’s bank account. However, if there are insufficient funds, the refund will be put on hold, and you will need to make sure that the balance is positive before the refund can be processed.“`

How long does it take for a refund to show as pending?

If you’ve ever received a refund for a purchase, you may have noticed that it sometimes shows as “pending.” This simply means that the seller has initiated the refund process, but the money has not yet been transferred to your account. The reason for this delay is that it takes time for the refund to clear the seller’s bank and be processed by your own financial institution. Typically, it can take up to five business days for a refund to be fully completed and for the funds to be available in your account.

Do refunds show in pending transactions?

It’s important to note that refunds typically won’t appear in your account until they have finished processing. This means that you may have to wait a few days or even a week before seeing the funds returned to your account. It’s important to be patient during this time and avoid making any additional purchases that could cause your account to go into the negative. Keep an eye on your account balance and check back periodically to see if the refund has been processed.

What time does refund go into bank?

“`After your refund has been processed, it typically takes between 1-3 working days for the funds to appear in your account. However, in certain circumstances, it may take up to a week. If you have been waiting for a refund that has not yet appeared, we recommend reaching out to the merchant to confirm that they have processed it.“`

What day of the week does IRS deposit refunds?

If you’re eagerly awaiting your tax refund, you’ll be pleased to know that the IRS usually processes and issues refunds via direct deposit within 21 days of receiving your tax return. Although the specific day of the week that your refund will be deposited may differ, the IRS typically distributes refunds on weekdays, from Monday to Friday. This means that you can expect to receive your refund within three weeks of filing your taxes, provided that there are no issues or errors with your return.

How many times a day does IRS deposit refunds?

According to the IRS, tax refunds will continue to be processed in the same manner until 2023. The IRS processes refunds twice a week, with direct deposit refunds being processed on the first day and refund checks being mailed to those who didn’t choose direct deposit on the second processing day. This system has been in place for some time and is expected to remain unchanged for the next few years.

What time should my tax refund be deposited?

According to the IRS, the majority of taxpayers can expect to receive their refunds within 21 days of filing their tax returns. However, if you opt for direct deposit, you may have to wait up to five days before you can access your funds. Alternatively, if you request a refund check, it could take several weeks to arrive in the mail. It’s important to keep these timelines in mind when planning your finances and budgeting for any upcoming expenses.

What time of day do direct deposits post?

If you’re wondering when your direct deposit will hit your account, the good news is that it’s usually available at the start of business on your payday, which is typically by 9 a.m. However, in some cases, you may have access to your funds even earlier, as early as midnight or 6 a.m.

on the day of your payday. This can vary depending on your bank and employer, so it’s always a good idea to check with them to get a more accurate estimate of when your direct deposit will be available.

Can direct deposits hit during the day?

If you’re someone who receives their paycheck through direct deposit, you’re likely already aware of the many benefits it offers. Not only is it a more secure way to receive your earnings, but it’s also incredibly convenient. However, you may still have questions about when exactly your funds will become available. In most cases, you can expect to have access to your direct deposit by 9 a.

m. on the day of your payday. In some instances, you may even be able to access your funds as early as 12-6 a.m.

This means you can start using your hard-earned money as soon as possible, without having to wait for a physical check to clear.

How late can direct deposit hit?

According to federal regulations, banks must ensure that direct-deposit funds are accessible for withdrawal by the next business day after the electronic payment is received. This means that customers can expect to have access to their funds quickly and efficiently, without having to wait for an extended period of time. This policy helps to ensure that individuals can manage their finances effectively and avoid unnecessary stress or inconvenience.

Why didn’t my direct deposit go through at midnight?

It’s worth noting that certain financial institutions may take a few hours after midnight to update their accounts. Nevertheless, the majority of banks finish processing direct deposits before 6 am, which means that many individuals can wake up the following day to find the funds already in their accounts.

Why is my refund still pending after 48 hours?

If you’re eagerly waiting for your tax refund and notice that your e-filing refund status is still pending or hasn’t changed after 48 hours, don’t worry. It’s best to wait an additional 24-48 hours before checking again. The IRS may be experiencing a surge in traffic, which can cause delays in processing returns. So, be patient and give it some time.

Why is my refund status stuck on processing?

There are various reasons why some tax returns take longer to process than others. One of the most common reasons is errors in the return, such as an incorrect Recovery Rebate Credit. Incomplete returns can also cause delays, as well as the need for further review by the IRS. It’s important to double-check your tax return for accuracy and completeness to avoid any unnecessary delays in processing.

Related Article

- Why Did My Parakeet Suddenly Die?

- Why Did My Opal Turn Yellow?

- Why Did My Mom Leave Me?

- Why Did My Instagram Highlights Disappear?

- Why Did My Hematite Ring Break?

- Why Did My Hedgehog Died Suddenly?

- Why Did My Grass Turn White?

- Why Did My Glass Candle Explode?

- Why Did My Fire Pit Explode?

- Why Did My Ex Unfollow Me?