If you’re considering using Afterpay to make a purchase, it’s important to note that the company has policies in place to ensure timely payments. Specifically, if you don’t make your first payment by the agreed-upon date, your account will be frozen. Additionally, Afterpay may reject any future transactions until you’ve settled any overdue balances or late fees. It’s always a good idea to read the terms and conditions carefully before using any financial service, including Afterpay.

How do I get Afterpay to unfreeze my account?

To get Afterpay to unfreeze your account, you should contact their customer service team as soon as possible. You can do this by logging into your account and clicking on the “Contact Us” button. Explain the situation and provide any necessary information they may need to verify your identity. Afterpay may have frozen your account due to missed payments or suspicious activity, so be prepared to address these issues.

Once you have resolved the issue, Afterpay should unfreeze your account and allow you to continue using their service. It’s important to stay on top of your payments and keep your account in good standing to avoid future issues.

Will I be able to use Afterpay again?

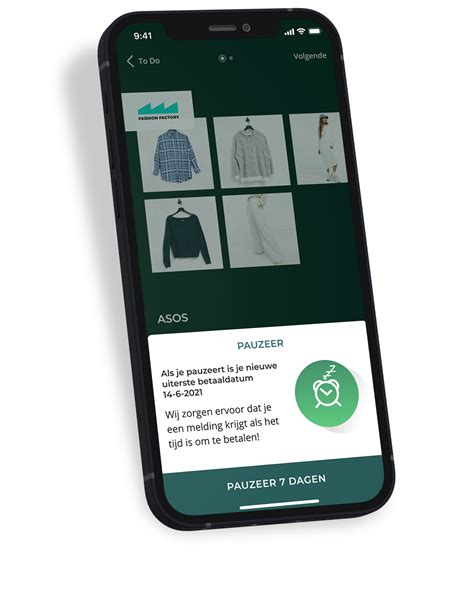

If you happen to miss a payment with Afterpay, your account will be temporarily frozen until the outstanding repayments are settled. It’s important to note that Afterpay does charge a late fee of $8, in addition to up to 25% of the order value. If you continue to fall behind on payments or have a history of overdue accounts, you may not be eligible to use Afterpay in the future.

Why has my Afterpay stopped working?

When using Afterpay, there are a few things to keep in mind to ensure a smooth transaction. Firstly, make sure there are enough funds on your card to cover the first installment of the order value. Afterpay typically checks for this before approving the transaction. Additionally, the length of time you have been using Afterpay can also affect your eligibility, with tighter restrictions in the first 6 weeks.

By being mindful of these factors, you can avoid any potential issues and enjoy the convenience of using Afterpay for your purchases.

Why did my Afterpay limit go to zero?

“`If you’ve ever experienced a decrease in your spending limit, it could be due to our system taking various factors into account, such as late payments. It’s important to note that missing a payment can also impact your tier within the Pulse Rewards program.“`

How do I get $3000 on Afterpay?

At present, Afterpay grants customers an initial credit limit of $600. However, this limit can be raised up to $3,000 if the customer makes payments consistently and on-time.

What’s the highest Afterpay limit?

The maximum limit for a single transaction with Afterpay is $1,500, and customers can have up to $2,000 as an outstanding balance. However, these limits are not fixed and can vary based on several factors, including payment history and the frequency of on-time payments.

Can I have 2 Afterpay accounts?

On the other hand, AfterPay has a more stringent policy when it comes to account regulations. As per their terms of service, it is strictly forbidden to have multiple accounts.

Does Afterpay increase credit score?

If you’re looking to improve your credit history, using Afterpay may not be the best option. This is because Afterpay doesn’t report its loans to credit bureaus, which means that your positive payment history won’t be reflected in your credit score. While it may be convenient to use Afterpay for purchases, it won’t help you build your credit in the long run. It’s important to consider other options if you’re looking to improve your credit score.

Can you get more than 600 on Afterpay?

If you’re an Afterpay customer, you’ll start off with a spending limit of $600. However, this limit can gradually increase over time as you continue to make timely payments and demonstrate responsible shopping habits. Essentially, the longer you’ve been using Afterpay and consistently meeting your payment obligations, the higher your spending limit is likely to become.

How do I get my Afterpay limit increase?

Are you an avid user of Afterpay and have consistently made timely payments? If so, you may qualify for a credit limit increase. To initiate the process, simply log into your Afterpay account and head to the My Account section. Once there, select the option to Request a Credit Limit Increase and follow the prompts provided.

Will my Afterpay limit ever increase?

At Afterpay, we place a high value on loyalty and timely payments. As a new user, your spending limit may be lower than someone who has been using our platform responsibly for a longer period of time. Generally, the longer you have been using your account and consistently making payments on time, the higher your spending limit is likely to be. We believe in rewarding responsible behavior and encourage our users to continue using Afterpay as a convenient and stress-free payment option.

Can you use Afterpay with no money in your account?

It’s a common question: can you use Afterpay if you have no money in your account? Unfortunately, the answer is no. To use Afterpay, you need to have some money available to pay for the first installment upfront. After that, you can split your purchases into four interest-free installments over a period of 6 or 12 months. While it may be tempting to use Afterpay to buy something you can’t afford right now, it’s important to remember that you’ll still need to have the funds available to cover the initial payment.

Can banks see if you use Afterpay?

If you’re considering using Afterpay to make purchases, it’s important to note that while it won’t appear on your credit report, it will show up on your bank statements. This is something that lenders will take into account when assessing your affordability for a loan. It’s always a good idea to be mindful of your spending habits and ensure that you’re able to comfortably manage any repayments, regardless of whether they’re through Afterpay or another payment method. By being responsible with your finances, you can avoid any potential negative impacts on your credit score or loan applications.

What is the downside of Afterpay?

Possible rewrite:

While Afterpay can be a convenient way to spread out the cost of purchases, it’s important to be aware of its potential drawbacks. One of the main disadvantages is the fees that can accumulate if you miss repayments. Although the initial fee for a missed payment is relatively low, it can increase if you continue to fall behind. This can create a cycle of debt that can be difficult to break free from.

Moreover, using Afterpay without a clear plan to pay off the debt on time can lead to financial stress, as you may end up paying more than you can afford or damaging your credit score. Therefore, it’s advisable to use Afterpay only if you’re confident that you can meet the repayments and avoid any unnecessary fees or stress.

Can Cashapp work with Afterpay?

Did you know that Cash App now allows you to make Afterpay payments? This means that you can split your purchases into four interest-free payments and pay them off over time. It’s a great way to manage your finances and avoid the stress of large upfront payments. Plus, with Cash App’s easy-to-use interface, making Afterpay payments has never been easier. So next time you’re shopping online, consider using Cash App to take advantage of this convenient payment option.

How do I get my Afterpay limit back up?

If you’re looking to increase your Afterpay limit, there are a few things you can do. Firstly, it’s important to be honest with your representative about your financial situation. This will help them understand your needs and potentially increase your limit. Additionally, making sure you pay on time and avoiding large purchases can also help increase your limit over time.

With a higher credit limit, you’ll have more flexibility to make larger purchases and pay them off gradually, which can be helpful for managing your finances.

What is the lowest limit for Afterpay?

When you sign up for Afterpay, you’ll be given an initial spending limit of approximately $600. However, this limit will gradually increase as you continue to use the service responsibly. As a new customer, your first payment will be due upfront. But if you consistently make all of your payments on time, you’ll be more likely to see your spending limit go up over time.

This means you’ll have more flexibility to make purchases without having to worry about paying for everything upfront.

Can I have 2 Afterpay accounts?

On the other hand, AfterPay has a more stringent policy when it comes to account regulations. As per their terms of service, it is strictly forbidden to have multiple accounts.

What does your Afterpay limit start at?

If you’re an Afterpay customer, you’ll start off with a spending limit of $600. However, this limit can gradually increase over time as you continue to make timely payments and demonstrate responsible shopping habits. Essentially, the longer you’ve been using Afterpay and consistently meeting your payment obligations, the higher your spending limit is likely to become.

Related Article

- Why Did Aegon Marry His Sister?

- Why Did Acrylic Tank Manufacturing Closed?

- Why Did Abram And Lot Separate?

- Why Did Abraham And Lot Separate?

- Why Did Aaron Kyro Leave Braille?

- Why Dental Implants Are So Expensive?

- Why Death Is Just An Illusion?

- Why Dachshunds Are The Worst Breed?

- Why Couples Therapy Doesn’t Work?

- Why Couldn’t Itadori Switch Back?