If you want to update the address on your personal checkbook, you can easily do so by ordering new checks through the methods mentioned earlier. These methods include online ordering or visiting the bank in person. Simply follow the instructions provided and you’ll have new checks with the updated address in no time.

Can I write my correct address on a check?

While it is not mandatory to include your address on a check, it is advisable to do so as several merchants may require it. In fact, some merchants may even expect to see your address on the check. To avoid any confusion or inconvenience, it is recommended that you include your current address on the check.

Can I deposit check with wrong address?

When depositing a check, it’s not necessary for the address to be correct in order for it to be valid. If the address is incorrect, you can simply cross it off and write the correct address underneath or in the memo line. Alternatively, you can place a sticker over the old address. However, it’s important to update the address in your bank’s records to avoid any potential issues.

What happens if a check is sent to the wrong address?

If you accidentally sent a check to the wrong apartment, don’t worry. First, contact your bank to check if the check has been cleared or not. If it hasn’t been paid yet, ask the bank to place a stop payment on the check and re-issue a new one. Keep in mind that some institutions may require your signature in person to place a stop payment. Best of luck!

How do I get rid of old address checks?

To get rid of old address checks, you can shred them or dispose of them in a secure manner. It’s important to properly dispose of any documents that contain personal information to prevent identity theft. You can also contact the institution that issued the checks and request that they be cancelled or replaced.

Do blank checks expire if the address is wrong?

Unused checks, commonly known as blank checks, are considered valid as long as the associated account remains active. These checks are considered truly blank when no details such as names, amounts, or dates are filled in. In general, they do not have an expiration date.

What makes a check invalid?

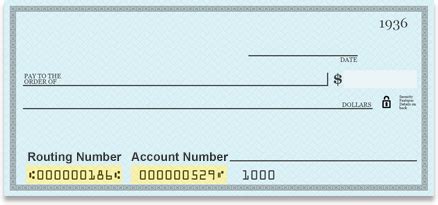

Banks typically decline to cash checks because of insufficient funds, but there are other reasons why checks may be rejected. These include unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or if too much time has passed since the printed date.

How long before a check becomes invalid?

Checks, whether personal, business, or payroll, have a validity of 6 months or 180 days. However, some businesses print “void after 90 days” on their checks, but this does not mean that the check is no longer valid after 90 days. Banks usually accept these checks for up to 180 days. The pre-printed language is intended to prompt people to deposit or cash the check as soon as possible.

What will make a check void?

A check can be voided for various reasons, such as if it is post-dated, if it is not properly filled out, if it is altered or if it is reported lost or stolen. Additionally, if the account holder has insufficient funds in their account, the check may bounce and become void. It is important to ensure that all checks are properly filled out and signed, and that there are sufficient funds in the account before issuing a check to avoid any issues with voiding.

What will void a check?

Once you have given a check to the payee, it cannot be voided. To prevent the check from being cashed or deposited, you must ask your bank for a stop payment, which may come with a fee. It is not possible to void a check once it has been given to the payee.

Can I write void on my own check?

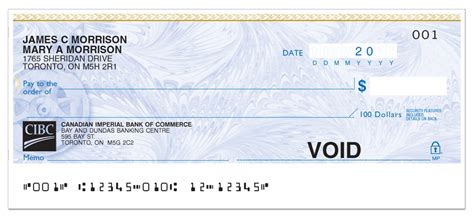

Voiding a blank or filled-out check is a simple process. All you need to do is write the word “VOID” in large letters across the entire check. This will render the check useless and prevent anyone from depositing it. Whether you have a blank check or a filled-out one, the process is the same. Just make sure to write “VOID” clearly and legibly to ensure that the check is properly voided. By voiding a check, you can protect yourself from potential fraud or errors and maintain control over your finances.

Can I cash a check if I wrote void on it?

It may come as a surprise, but a check that has the word VOID written prominently on the front can still be cashed.

What is the difference between a voided check and a canceled check?

Canceled and voided checks are two different things. A canceled check is one that has been paid by a financial institution, while a voided check is one that the account holder has marked with the word “void” to prevent it from being used for fund transfers.

Can I throw away deposited checks?

After scanning and submitting your deposit, make sure to label the checks as deposited, along with the date, and store them in a safe place until you dispose of them. It’s important to note that there are no legal requirements dictating how long you must keep the original checks.

How long should you keep old check registers?

It is advisable to maintain checkbook registers for a minimum of 12 months as it can help resolve any payment-related queries that may arise. Additionally, certain checks may take longer to clear, and having a record of them can be useful. Therefore, it is recommended to keep track of your financial transactions by maintaining checkbook registers for at least a year.

Should I shred old checks?

In today’s digital age, many banks have switched to electronic formats for canceled checks. However, if you still have physical copies or reprints from your bank, it’s important to shred them. These checks contain a significant amount of personal information that could potentially put you at risk of identity theft or fraud. To protect yourself, it’s best to dispose of canceled checks properly and securely.

Can I throw away checks from closed account?

It’s not advisable to throw away checks from a closed account. Instead, it’s better to destroy them to avoid any potential issues. These checks may still be used, but they will bounce, and it can lead to complications such as determining the account holder and when the checks were issued. If the checks were issued before the account was closed, it could result in legal trouble.

Related Read:

Rewrite A Mq4 Code To Work On Thinkorswim

Rewrite An Address On A Package

Rewrite Agpl Software

Rewrite A Sim Card

Rewrite And Republish An Old Book

Rewrite Cd-R

Rewrite Apgl Software

Rewrite Matric At Unisa

Rewrite Information From A Book

Rewrite How Games Got Full Screened

Rewrite Dvd R

Rewrite Code I Wrote At Work

Rewrite My Fiduciary In My Will For Estate

Rewrite My Fiduciary In My Will

Rewrite My Logbook For Pilot