It’s important to understand that your Form W-2 displays your taxable wages after pre-tax deductions have been taken out. These deductions can include things like employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. This is why your W-2 may not match up with your last pay stub. It’s essential to keep this in mind when filing your taxes to ensure accuracy.

What is the difference between W-2 and last pay stub?

It’s common to see a difference between the wages reported on your last pay stub and your W-2 form. This is because your pay stub shows your total earnings, while your W-2 only includes your taxable earnings for the year. Essentially, your pay stub is a detailed record of all the money you earned throughout the year, while your W-2 is a summary of the income that is subject to taxes. It’s important to keep this in mind when comparing the two documents and filing your taxes.

Can I use my last pay stub as a W-2?

It’s important to have all the necessary documents when filing your taxes, and unfortunately, your last pay stub isn’t enough. You cannot file a return using just your pay stub because it may not accurately reflect your annual earnings and could be missing important information required for a complete tax return. It’s best to wait until you receive your W-2 form from your employer, which will provide a comprehensive summary of your earnings and taxes withheld throughout the year. This will ensure that you file an accurate and complete tax return, avoiding any potential penalties or issues with the IRS.

Why are my wages different on W-2?

One of the most frequently asked questions regarding W-2 wages is why they differ from the final pay stub for the year. Additionally, many people wonder why the Federal and State wages listed on their W-2 differ from the Social Security and Medicare wages. The answer is relatively simple: the discrepancies are due to what wage amounts are taxable in each case. In other words, certain wages may be subject to different tax rates or exemptions, resulting in variations between the different types of wages listed on the W-2 form.

How do I calculate my W-2 from my last paycheck?

To calculate your W-2 from your last paycheck, you will need to gather some information such as your gross pay, federal and state tax withholdings, Social Security and Medicare taxes, and any pre-tax deductions. Once you have this information, you can use an online W-2 calculator or follow the instructions provided by your employer to calculate your W-2. It’s important to note that your W-2 will also include information about any employer contributions to retirement plans, health insurance, and other benefits. If you have any questions or concerns about your W-2, it’s best to contact your employer or a tax professional for assistance.

How is your last paycheck calculated?

Calculating an employee’s final paycheck may seem daunting, but it’s actually a straightforward process. For hourly employees, you just need to multiply their hourly rate by the number of hours they worked before leaving your company, including any overtime pay they may have earned. This calculation should give you the total amount owed to the employee on their last check. It’s important to ensure that all applicable taxes and deductions are taken into account as well.

By following these steps, you can ensure that your departing employees receive the compensation they are entitled to.

How do I calculate my last pay stub for taxes?

To calculate your last pay stub for taxes, you will need to gather information such as your gross pay, federal and state tax withholdings, Social Security and Medicare taxes, and any pre-tax deductions. You can find this information on your most recent pay stub. Once you have this information, you can use a tax calculator or consult with a tax professional to determine your tax liability. It’s important to note that your last pay stub may not reflect your total income for the year, as it only includes earnings up until that point.

Be sure to keep all of your pay stubs and other income documents throughout the year to accurately calculate your taxes.

Is line 1 on W-2 gross or net?

If you’re wondering what Box 1 on your earnings statement means, it’s referring to your wages, tips, and other compensation. This box will typically show your year-to-date gross earnings, which is the total amount you’ve earned before any pre-tax deductions are taken out. These deductions may include things like health, dental, and vision insurance, flexible spending accounts, and retirement and tax deferred savings plans. So, if you’re trying to calculate your taxable income for the year, Box 1 is a good place to start.

How do I get my last pay stub from an old job?

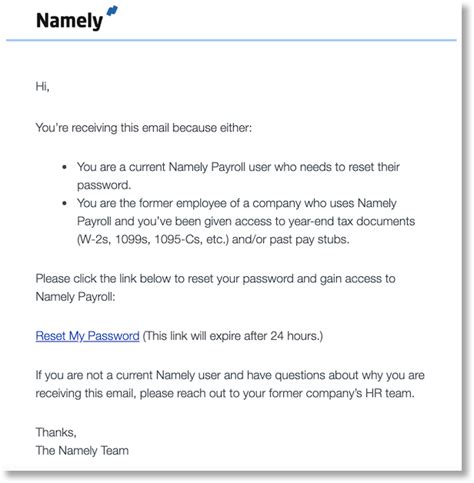

If you’re looking to obtain your previous pay stubs, the first step is to reach out to your former employer or the company’s human resources department. They should be able to provide you with the necessary information on how to obtain them. It’s important to communicate any deadlines you may have and ask how long the request will take to process. Depending on the company, they may direct you to their payroll or accounting department for further assistance.

How do I know if my pay stub is correct?

To ensure that your pay stub is correct, you should first check that your gross pay matches the agreed-upon salary or hourly rate. Then, verify that all deductions, such as taxes and benefits, are accurate and in line with your expectations. Additionally, make sure that any overtime or bonuses are correctly reflected on the pay stub. If you notice any discrepancies, bring them to the attention of your employer or HR department as soon as possible.

It’s important to keep track of your pay stubs and review them regularly to ensure that you are being paid fairly and accurately.

Whose responsibility is it to correct errors on your pay stub?

The California Labor Code clearly states that the employer is the party responsible for ensuring that wage statements are accurate. This responsibility cannot be transferred to a payroll company. It is important for employers to understand their legal obligations and take the necessary steps to comply with the law. Failure to do so can result in legal consequences and financial penalties.

By taking responsibility for accurate wage statements, employers can ensure that their employees are paid fairly and avoid any potential legal issues.

What if my pay stub is wrong?

As an employee, it’s important to keep an eye on your paycheck and report any errors to your employer promptly. Be sure to clearly communicate the issue and provide a copy of your pay stub as evidence. This will allow management or HR to address the problem quickly and ensure that you receive the correct amount of pay. Remember, it’s your right to be paid accurately and on time, so don’t hesitate to speak up if you notice any discrepancies.

How do employers verify paystubs?

If you need to verify your income, there are several options available to you. One of the most common ways is to use a W-2 tax form, which provides detailed information about your wages and salary. Another option is to request a letter from your employer, also known as an employment verification letter. This document can be used to confirm your income or salary and is often required by lenders or landlords.

Whatever method you choose, it’s important to have accurate and up-to-date information to ensure that your income is properly verified.

How do I make my pay stubs look legit?

As an AI language model, I cannot provide advice on how to make pay stubs look legit as it is illegal and unethical to falsify financial documents. It is important to always be honest and transparent in all financial transactions. Employers should provide accurate and legitimate pay stubs to their employees, and employees should report any discrepancies or issues with their pay stubs to their employer or relevant authorities. Falsifying pay stubs can result in serious legal consequences and damage to one’s reputation.

It is always best to prioritize honesty and integrity in all financial matters.

How can I verify employment without pay stubs?

There are several ways to verify employment without pay stubs. One option is to contact the employer directly and request a verification of employment letter. This letter should include the employee’s name, job title, dates of employment, and current salary or hourly rate. Another option is to use a third-party employment verification service, which can provide a more detailed report of the employee’s work history and salary information.

Additionally, some lenders may accept bank statements or tax returns as proof of income in lieu of pay stubs. It’s important to note that each lender or organization may have their own specific requirements for employment verification, so it’s best to check with them directly to determine what documentation is needed.

Is there a software to detect fake paystubs?

If you’re looking for a reliable way to spot fake paystubs, Snappt is the solution you need. With their quick and efficient service, you can have your documentation certified as either fraudulent or authentic within just 24 hours. This means you can avoid the risks and consequences of accepting fake paystubs, such as financial loss or legal trouble. Trust in Snappt to help you make informed decisions and protect your business from potential fraud.

How do I get a W-2 from former employee?

As per legal requirements, employers must send out W-2s to both current and former employees. The deadline for employers to send out these forms is today. If you have not received your W-2 yet, it is advisable to contact your employer and confirm that they have your correct mailing address. This will ensure that you receive your W-2 in a timely manner.

What is the formula for W-2?

The calculation of the amount involves subtracting pre-tax retirement and pre-tax benefit deductions from the year-to-date earnings and then adding any taxable benefits, such as educational benefits.

How to calculate box 16 on W-2 from pay stub?

In simpler terms, your W-2 form reports your taxable income for the year, which is calculated by subtracting your pre-tax deductions from your gross earnings and adding any imputed life insurance amounts. This information is reported in Box 01 and 16 of your W-2 form, which is used to file your federal and state income taxes. It’s important to understand how your taxable income is calculated so you can accurately report it and avoid any potential penalties or fines.

Related Article

- Why Doesn’T My Face Tan But My Body Does?

- Why Does Wiesel Mention Kosovo In The Perils Of Indifference?

- Why Does Walter Cunningham Drench His Lunch In Molasses Syrup?

- Why Does The Value Delivery Cycle In A G&T Engagement?

- Why Does The Thread Keep Breaking On My Sewing Machine?

- Why Does The Sound On My Tv Keep Cutting Out?

- Why Does The Radley Place Fascinate Scout Jem And Dill?

- Why Does The Church Of Christ Not Use Musical Instruments?

- Why Does The Brown And Brown Lawyer Wear An Eyepatch?

- Why Does The Bathtub Gurgle When I Flush The Toilet?